In a shocking development that could reshape the future of Social Security, the Department of Government Efficiency (DOGE) has reportedly uncovered what officials are calling “the largest fraud in history” within the Social Security system.

According to recent statements from DOGE head Elon Musk, the magnitude of fraud within federal entitlement programs, including Social Security, Medicare, Medicaid, and disability benefits, “exceeds the combined sum of every private scam you have ever heard of by far.”

6.5 Million “Ghost” Beneficiaries Over Age 112

At the center of these allegations is a startling claim: Social Security’s database contains 6.5 million active accounts for individuals purportedly over 112 years of age. For context, there are typically only about 40 people worldwide who reach this advanced age at any given time.

The issue is not newly discovered. A 2015 Inspector General report highlighted the same problem, noting that Social Security did not have death records for millions of people with the oldest recorded birth date going back to 1869. Yet nearly a decade later, the issue appears to remain largely unresolved.

“Social Security’s database is not deduplicated, meaning that you can have the same Social Security number many times over, which further enables massive fraud,” Musk stated on his social media account. “Your tax dollars are being stolen.”

Billions in Fraudulent Payments

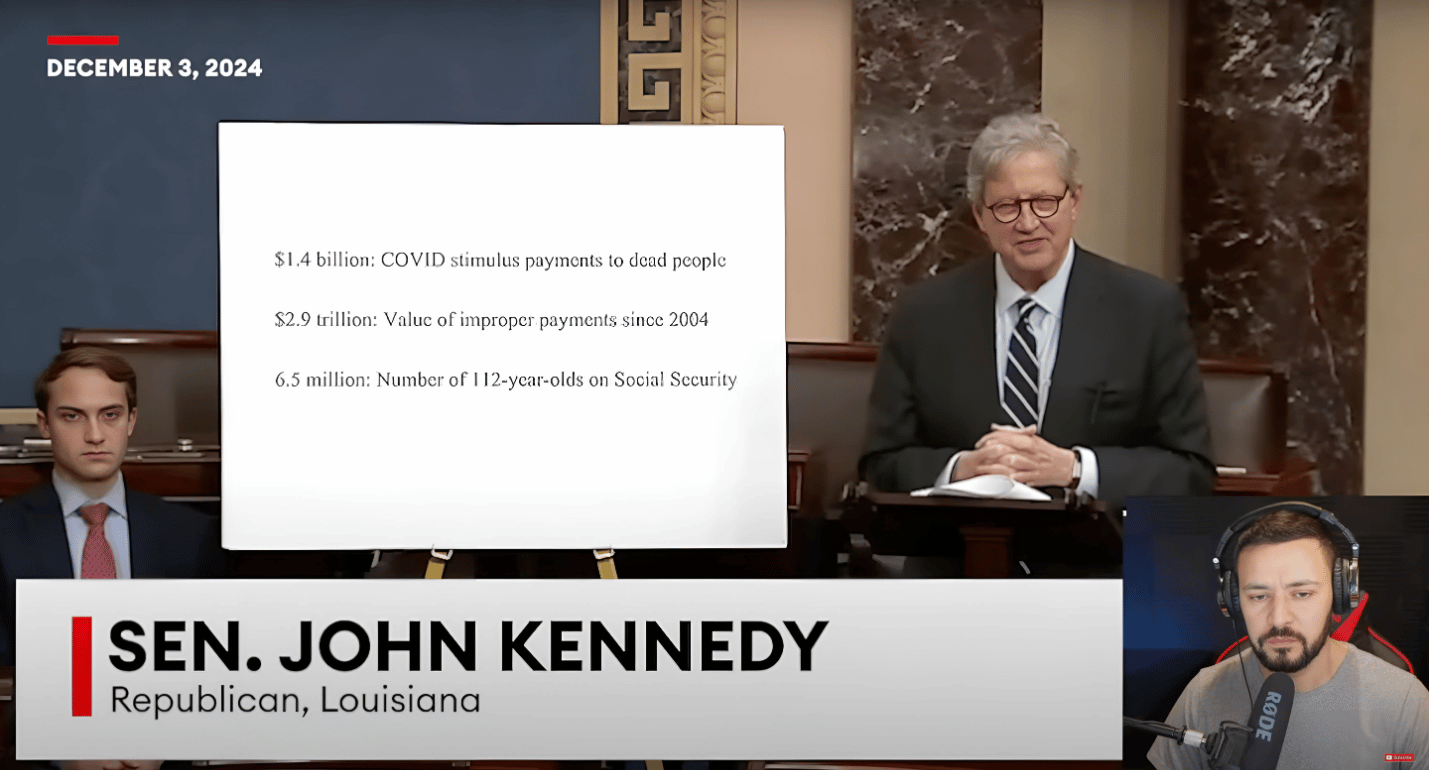

According to testimony from Senator John Kennedy in December 2024, this system vulnerability has enabled widespread fraud:

- $1.4 billion in COVID stimulus payments went to deceased individuals

- Nearly 67,000 of these Social Security numbers were used to report over $3 billion in wages, tips, and self-employment income over a five-year period

- One Social Security number was reportedly used 613 different times

- 194 numbers were used at least 50 times each

“I can’t emphasize enough that the goal of auditing the Social Security Administration is to stop the extreme levels of fraud that is currently taking place so that it remains solvent and protects the Social Security checks of honest Americans,” Musk emphasized. “That’s it. That’s the goal. End of story.”

Long-Standing Issue, Little Action

What makes this situation particularly concerning is that these problems have been documented for years. In 2015, then-Acting Assistant Attorney General Carolyn Calo described how the fraud typically works:

“The plan is frighteningly simple. You steal a Social Security number, file tax returns showing a false refund claim, and then have the refunds electronically deposited or sent to an address where the launderer can access the refund checks.”

Social Security officials previously acknowledged the issue but cited the challenge of updating millions of paper records generated before the agency’s switch to electronic systems in 1972. The agency stated it would be “costly and time-consuming” to fix the entire database.

What This Means for Beneficiaries

For the millions of Americans who legitimately depend on Social Security for retirement, disability, or survivor benefits, this revelation raises serious questions about the program’s future.

If the fraud is as extensive as claimed, addressing it could potentially:

- Extend Social Security’s solvency beyond the currently projected 8-12 years

- Free up funds that could enhance benefits for legitimate recipients

- Lead to stricter verification systems that could temporarily complicate the application process

Former Social Security Commissioner Martin O’Malley has reportedly pushed back against DOGE’s investigation, urging Musk to “keep his hands off Social Security.”

Broader Implications

This development comes in the third week of President Trump’s administration, which has already made significant moves on border security, international trade, and now appears to be turning its attention to domestic programs.

President Trump previously mentioned concerns about Social Security fraud during the Japanese Prime Minister’s visit, specifically highlighting issues in California where he claimed illegal immigrants were committing fraud against the system.

The controversy joins other recent Social Security developments, including proposals to eliminate double taxation on benefits and pauses in payments to beneficiaries living outside the United States.